Electronics and electrical equipment manufacturing continues to grow but hesitantly, as political and fiscal uncertainty maintains its restraining grip on the economy.

Innovation, embedded systems and cross-industry cooperation will be the signature to growth for UK electronics.

As the decade draws to its end, three years of expectation and uncertainty surrounding the UK’s withdrawal from Europe is continuing to hold UK manufacturing industry back by the reins as foreign investment stalls and decision makers hedge their bets.

Despite this, output in the electronics and electrical equipment segments has remained stable, with a small amount of growth. The UK continues to be seen as a hotbed of innovation, particularly in automotive, aerospace and test & measurement markets. With high levels of innovative churn in these industries, both established and start-ups are showing their competitive strengths.

Industry is also supported by strong academic alliances as well as Government programmes designed to provide investment, assistance in taking concepts through to production and support for reaching new markets.

On this landscape, current performance is expected to continue through the forthcoming period of political uncertainty, placing it in a strong position for growth once trade agreements, tariffs and customs procedures have been set in place.

Innovation provides key to growth

All sectors of UK manufacturing have long realised that box-shifting or high volume cost-focused manufacturing is not a national strength and it’s hard to compete against nations that are more aligned towards fast moving output.

The country has been a pioneer in many areas of technology throughout its industrial history in aerospace, railways, automotive and electronics as well as manufacturing process technology. All of these areas are still subject to high levels of innovative growth and British scientists and engineers are continuing to prove they’re at the cutting edge.

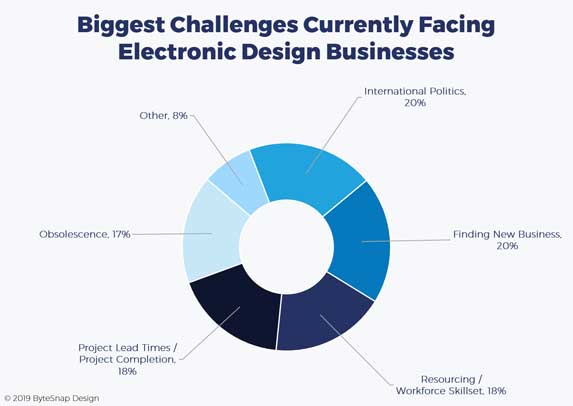

A fifth of electronics manufacturing company senior managers see international politics as their biggest challenge.

During the past 12 months, both start-ups and established manufacturers have seen a growth in activities relating to product innovation, prototyping and advanced manufacturing for niche sectors.

Electronics technology cuts across all industrial sectors and is at the heart of the changes that are taking place in Industry 4.0, Connected Autonomous Vehicles, Collaborative Robots and Test & Measurement Systems, to name but a few.

Markets on the move

Collaborating with other technology suppliers such as these is a key theme in the current electronics and electrical manufacturing landscape.

At a press briefing held in early 2019 at the Millbrook proving grounds, Bedfordshire, the automotive testing organisation of the same name was showcasing its connected smart city test site equipped with 5G wireless and electronics communication technology. Addressing journalists, Millbrook’s CEO Alex Burns was highly optimistic about the level of collaboration between the electronics and automotive industries for the future of British enterprise.

“This is a superb opportunity which we’re very excited about. Millbrook has never in its history been host to as many specialists from outside the automotive sector as we have today,” he said.

Aerospace, defence and the railway sectors are also benefiting from large scale cooperation with electronics too, beyond their traditional connections for component supply. The trend now is for simulation, digital twinning, Hardware-inthe- Loop (HIL) testing, “train zero” connected prototyping and monitoring. All of these require test equipment, sensors, data acquisition systems, advanced electronics design skills and a high degree of connectivity.

Technology Transfer

Electronics for test and measurement systems grew strongly last year. The segment is expected to maintain its growth

There are also current examples of technology applications that are seeing growth in commercial sectors that originate in the defence industry, creating opportunities for growth. A very high profile example is the growth in the commercial use of aerial drones but this is also the case for electrical equipment in other segments.

One example is RFI (Radio Frequency Interference) equipment. With the growth of connected systems in the home, on the road and on the factory floor, there is a growing problem of electro-magnetic compatibility (EMC). Under current European standards, anything with an antenna in it needs to conform to stringent EMC requirements, so the level of testing has increased dramatically. EMC test house capacity is stretched and more companies are opting for in-house facilities.

One company that specialises in RFI filters for the defence industry, MPE in Liverpool, has recently expanded to meet the needs of the commercial market and is planning further expansion to cope with expected demand. During a recent visit to MPE, the company’s Director, Paul Currie told me,

“Our roots are in the defence industry and we’ve always had a stable business with them but we’re now being approached more often by companies in the commercial sector that need our products. We have the space to expand to meet this demand and we’re planning that now.”

Product Volume Performance

Table 1 shows the financial revenue performance for UK electronics manufacturing. This has been largely flat for most product groups with a small uplift last year in populated electronic boards. However, this still didn’t attain the same levels as 2013. In line with the cross-industry collaboration on new product introduction and growth in electronic content, the “measuring and test instruments” product group showed the greatest growth last year and this is expected to continue.

Table 2 shows the same metrics for electrical equipment products with a similarly flat profile except for wiring devices, which leapt in 2017 and has maintained its higher level, and domestic appliances, which crept up last year but still didn’t reach 2013 levels.

LOOKING AHEAD TO 2020

New technology and innovation feature highly in predictions for the industry over the next 12 months with a rise in demand for embedded systems. One UK manufacturer, JJM Manufacturing, sees investment in technology as the key to its success and believes that developing sectors will provide the opportunity for growth.

Analysts at Infosys Consulting reflect that view, predicting that 5G, smart factories and emerging technologies in innovative markets such as automotive will drive growth in electronics.

There are nonetheless still fears around political uncertainty and the obsolescence caused by rapid innovation. Embedded Systems consultancy, ByteSnap Design, surveyed electronics company executives at the 2019 Engineering Design show with 20% citing Brexit as their biggest challenge along with meeting skills requirements and coping with obsolescence.

At the Advanced Engineering Show 2019, Tim Figures of Make UK (formerly the Engineering Employers’ Federation) told delegates in a packed open forum that uncertainties surrounding the Brexit debate are likely to persist for some time. “Even if a deal is concluded, it will take months or even longer to regain stability,” he said.

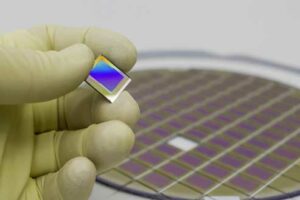

Wafer fabrication capacity in Greenock is to be expanded with a £30m inward investment.

WAFER FABRICATION INVESTMENT IN SCOTLAND

Greenock near Glasgow has been in the heart of what was once Scotland’s emerging silicon valley for decades with one of its core companies being Texas Instruments (TI). The take-over of TI’s wafer fabrication plant in February 2019 by Diodes Inc. ended the threat of closure after TI had announced it was withdrawing operations from the town three years earlier.

Now, Diodes is investing £30m into the plant to modernise existing equipment and replace key staff, who had left during the threat of closure.

According to Diodes CEO, Dr Keh-Shew Lu, the re-equipped plant will provide the wafer fabrication capacity needed by the company to meet its automotive electronics expansion initiatives.

“Our technical and operational performance expectations will be met with the excellent wafer fab know-how and engineering skills that exist at the plant,” he said.

The company’s other UK facility in Oldham, Lancashire won an electronics industry TechWorks award for its performance and innovation.